All the Tools & Courses You Need to Master Corporate Tax Preparation

Grab Anita Monrroy’s curated toolkits and live courses perfected over 22 years and used today at the CPA firm.

Curso de Corporaciones S y LLC

Dirigido por Anita Monrroy, CPA, EA, MST, esta serie práctica te brinda dominio completo de las dos estructuras comerciales más populares—con estrategias prácticas que puedes usar de inmediato. Las Sesiones: Parte 1: Corporaciones S 25 de Noviembre, 2025 | 1-5 PM PST Domina los fundamentos de las Corporaciones S, preparación del Formulario 1120-S, base de accionistas, compensación razonable y planificación fiscal estratégica. Parte 2: LLC 29 de Diciembre, 2025 | 1-5 PM PST Profundiza en estructuras de LLC, opciones de clasificación fiscal, LLCs de un solo miembro vs. múltiples miembros, estrategias de impuesto sobre trabajo por cuenta propia y conversión entre tipos de entidades. Lo Que Hace Esta Serie Especial: 8 horas de instrucción experta cubriendo ambas entidades en profundidad Casos prácticos reales con aplicaciones inmediatas Formato en línea—asiste desde cualquier lugar Serie completa por menos de la mitad del precio individual

$379.00 USD

Análisis Profundo: Temas avanzados de impuestos corporativos

Go beyond the basics into the complex scenarios you'll encounter with real clients. Master the nuances that separate beginners from confident professionals.Start Date: January 20th, 2025

$547.00 USD

Mis Centavos Membership Tools

Corporate Tax Preparation Guides

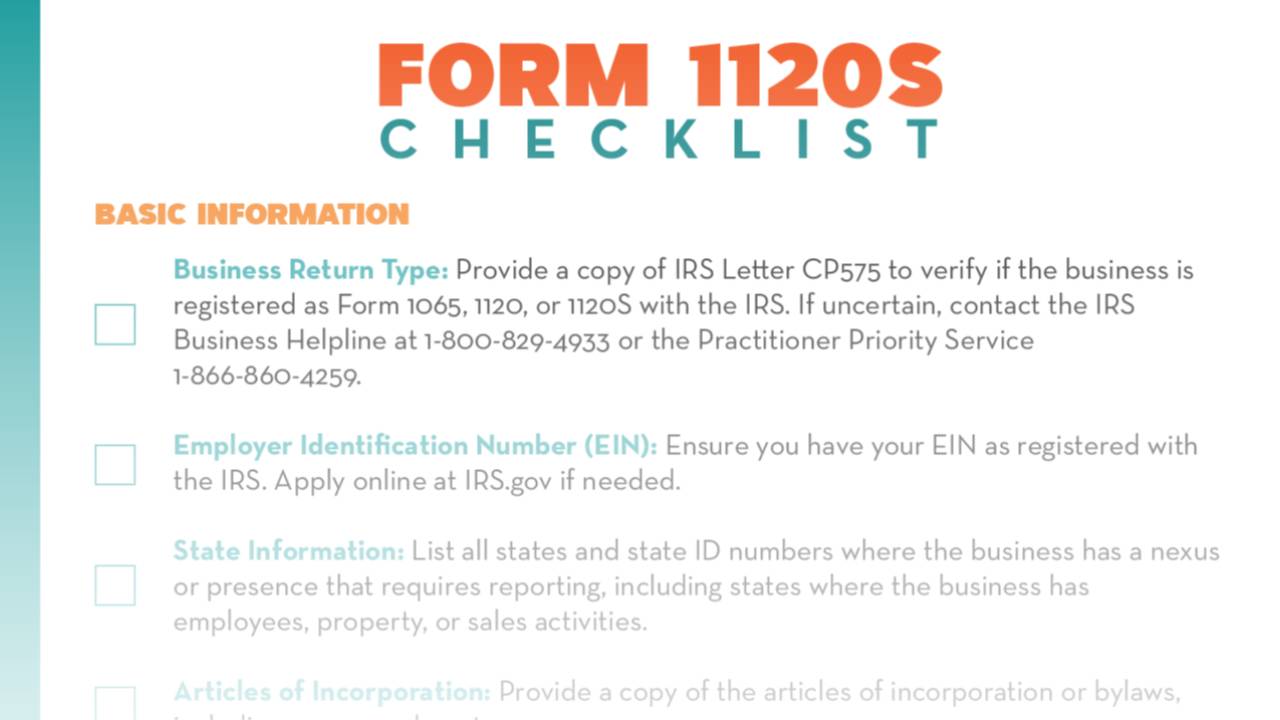

Form 1120S Tax Preparation Checklist

Everything you need to collect for a clean S-Corp return—on one page. This checklist covers Basic Info, Shareholders, Documents Received, Business & Financial Records, and Asset Records (acquisitions, disposals, mileage), so you can scope work, prevent rework, and file confidently. You’ll get: Clear intake prompts for shareholder data, ownership changes, and officer compensation Financials checklist (TB, P&L, Balance Sheet) plus payroll/1099 reporting Multi-state guidance (sales, payroll, property by state) Asset and vehicle sections ready for your depreciation and mileage workflows Printable, desk-side reference for team and client onboarding

$7.99 USD

Form 1120 Tax Preparation Checklist

Collect everything you need for a clean C-Corp return—fast. This one-pager covers Basic Info, Shareholders, Required Documents, Financials, and Assets (acquisitions, disposals, mileage), so you can scope work, prevent rework, and file confidently. Note: This is the exact checklist Anita Monrroy, CPA, EA uses at Mis Centavos in her corporate tax workflow. You’ll get: A clear intake list for Form 1120 (federal & multi-state considerations) Prompts for ownership changes, carryovers, payroll, and inventory Asset details (basis, service dates, depreciation) ready for your tax software A printable, desk-side reference for team and client onboarding

$7.99 USD

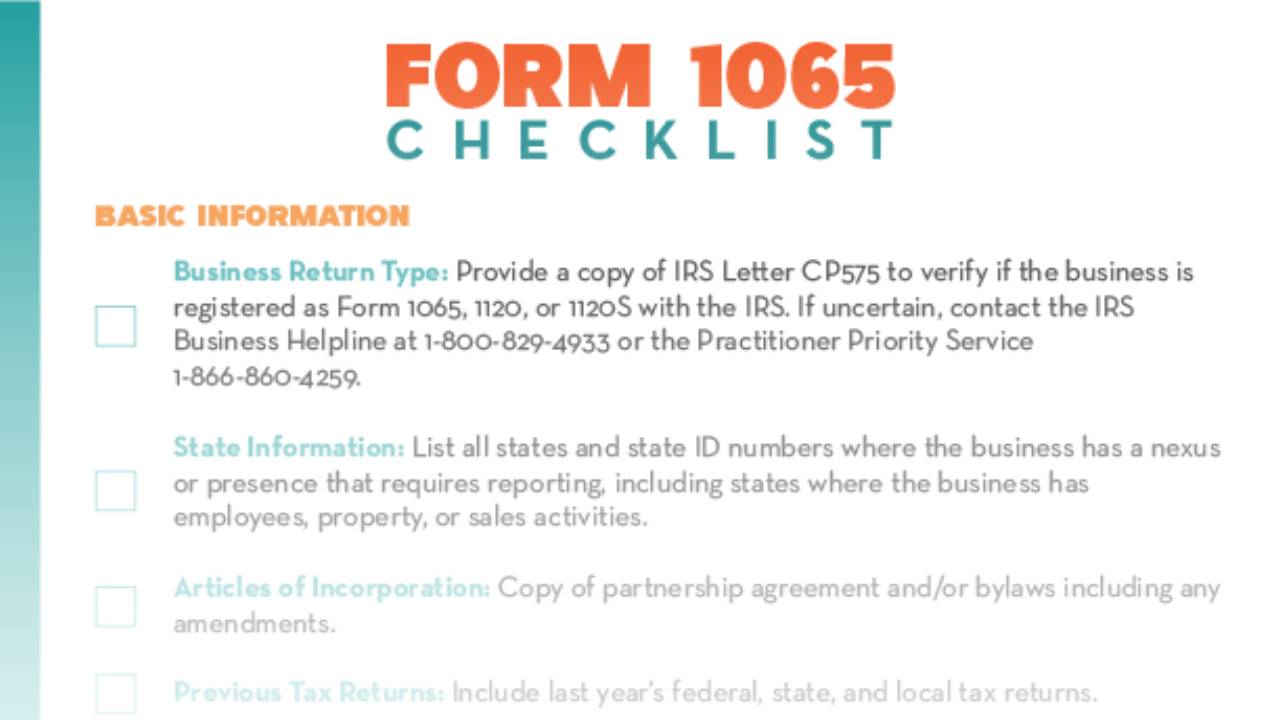

Form 1065 Tax Preparation Checklist

Collect everything you need for a clean partnership return—on one page. This checklist covers Basic Business Info, Partner Details (ownership %, capital, loans, guaranteed payments), Documents Received (1099s, K-1s), Business & Financial Records (TB, P&L, Balance Sheet, payroll, 1099/W-2 summaries), Multi-State reporting (sales, payroll, property), Inventory, and Asset Records (depreciation, acquisitions/disposals, vehicles & mileage). Use it to scope work, prevent rework, and file confidently. You’ll get: Clear intake prompts for partner data, ownership changes, and contributions/withdrawals Accounting artifacts checklist (year-end bank/CC statements, TB, financials, payroll tax reports) Multi-state worksheet guidance and inventory details for COGS Asset/depreciation and vehicle sections ready for your tax software

Free

FEATURED OFFER

FREE

Highly requested

- Bookkeeping Client Intake

- Form 1065 Partnership Checklist

- Nonprofit Dissolution Letter Template

- Head of Household Eligibility Flowchart

All the Tools You Need to Speed Up Tax Prep

Grab Anita Monrroy’s curated toolkit—perfected over 22 years and used today at her CPA Firm Get the Bookkeeping Intake, 1065 Checklist, Nonprofit Dissolution Letter, and HOH Flowchart to collect complete info on the first try and file with confidence.